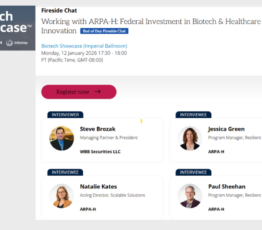

WBB Securities President Dr. Steve Brozak to Moderate ARPA-H Panel at Biotech Showcase 2026 on Federal Investment in Biotech Innovation

WBB Securities President Dr. Steve Brozak moderated a panel at Biotech Showcase 2026 focused on ARPA-H and the role of federal investment in advancing biotech and healthcare innovation. The discussion featured senior ARPA-H leaders and explored how government and industry can work together to accelerate breakthrough science and real-world impact.

Read More about WBB Securities President Dr. Steve Brozak to Moderate ARPA-H Panel at Biotech Showcase 2026 on Federal Investment in Biotech Innovation